Tale of 2 currencies

One might notice the common use of US dollar as a medium of exchange in Cambodia, despite the country having its own official currency – Cambodia Riel.

Dollarisation in Cambodia traces back to the 1970s where Riel was abolished during the Pol Pot’s regime. Despite the reinstatement of Riel in 1980s, businesses and households remained wary of the Riel, which was exacerbated by the rapid currency depreciation in the early 1990s when Cambodia was in transition to a market economy. At the same time, humanitarian aids were pouring into the nation following the collapse of the socioeconomic system, resulting in billions of USD inflow within a short timeframe, which was considerable for the Cambodian economy at that time.

Today, dollar accounts for ~ 80 – 90% of the money in circulation in Cambodia and ~ 86% of loans are conducted in USD, while private sector wages continue to be denominated in the US currency.

What it means for Cambodia?

In a way, dollarisation has prevented capital flight and promoted financial deepening in Cambodia, spurring the growth of the financial sector in recent years. This is especially significant during the Asian Financial Crisis, where Cambodia was left pretty much unscarred. Stability of the dollar also facilitated Cambodia’s integration into the international trade and economy and promoted macroeconomic stability for the country.

However, dollarization has also brought about limitations to the effectiveness of the conduct of monetary policy in Cambodia.

According to National Bank of Cambodia (NBC), the “principal mission of the Central Bank is to direct monetary policy aimed at maintaining price stability in order to facilitate the economic development of the Kingdom”

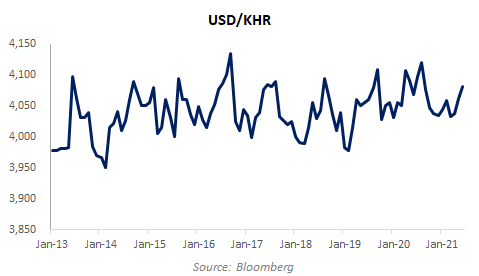

The highly dollarized environment had nonetheless restricted the ability of the government to conduct effective monetary policy and to fulfil its role as lender of last resort for banks facing liquidity problems. Open Market Operation (OMO) monetary tool is not effectively at the disposal of the government, as such, the achievement of price stability has been mainly conducted through adopting a stabilised rate regime, where the government intervenes into the market to maintain USD/KHR exchange rate within the band of acceptable range.

In addition, as Cambodia economy continues to grow, the loss of seignorage (profits made by government through issuing currency) becomes larger and so is the cost of dollarisation in the country.

Route to De-dollarisation …

Cambodia has been taking steps towards de-dollarisation, however, the route continues to be one of a long journey and NBC has issued three 10-year blueprints towards this long-term target. History has shown that hastily planned de-dollarisation (#zimbawe) could lead to hyperinflation, capital flight and eventual macroeconomic instability.

Back to the core, successful de-dollarisation must be coupled with (i) Price Stability (ii) Sustainable Macro Outlook (iii) Confidence in Riel (iv) Increase Reliance on Riel Circulation …

Notably in May 2020, NBC instructed banks and MFI to collect US small bills ($1, $2, $5) within 3 months so as to pull it out of circulation and for it to be replaced by riel bills. However, local experience in Phnom Penh does reflect the hard reality of the difficulty in executing which. Many stores here are still reflecting prices in USD, albeit changing, and tourists continue to encourage inflow of USD small bills.

Looking into Cambodia’s performance thus far, the country has been clocking improving trend, however, deposit and loan dollarisation still linger in the high range despite of better interest rate offer for Riel. Additionally, the recent trend has also highlighted a widening currency mismatch risks for financial institutions here.

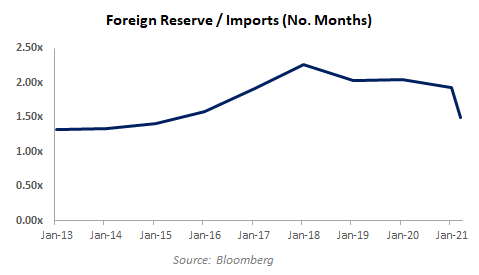

On the front of promoting price stability, Riel has maintained a relatively stable exchange rate against USD, while foreign exchange reserve stands at ~US$17bn as at April 2021, equivalent to ~ 1.5 – 2.0 months of imports. Inflation has also been kept at ~ 2.0 – 3.0% over the last decade, indicating the relative success of the government in maintaining price stability while promoting GDP growth. Nonetheless, as the economy grows larger under the shadow of dollarisation, the cost of monetary policy to effect the economy becomes larger.

Moving forward, it is essential for Cambodia to continue strengthening the public and business’s confidence in Riel while laying alongside policies to promote Riel circulation. Banking structure also needs to gradually reduce its Assets & Liabilities denominations in USD. An interesting point of thought will be on how Technology companies can play a role in de-dollarisation as Cambodia leapfrogged from a Cash Economy to a Digital Economy.

What will be your guess on how long it will take for Cambodia to achieve de-dollarisation?

Disclaimer: The information provided on jhterra.com (the “Site”) is for general informational purposes only. All information on the Site is provided in good faith, however we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information on the Site.