Banking Landscape in Cambodia

Cambodia banking system was destroyed during Khmer Rouge period and was only restored in 1993. Today, private banking institutions in Cambodia is a composite of (i) Commercial Banks (ii) Specialised Banks (iii) Microfinance Institutions (MFIs) and (iv) NGOs involved in rural credit activities.

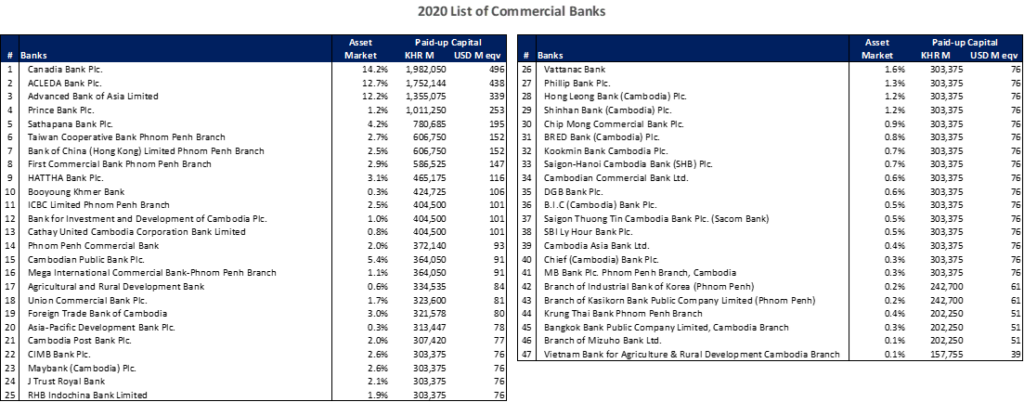

As at December 2020, Cambodia has 51 commercial banks, 12 specialised banks, 6 deposit-taking MFI, 75 non-deposit-taking MFI and 245 rural credit institutions – A rather crowded scene for an emerging market with a GDP size of ~US$26 billion. In comparison, Thailand has only 30 commercial banks but with a GDP ~20x of Cambodia.

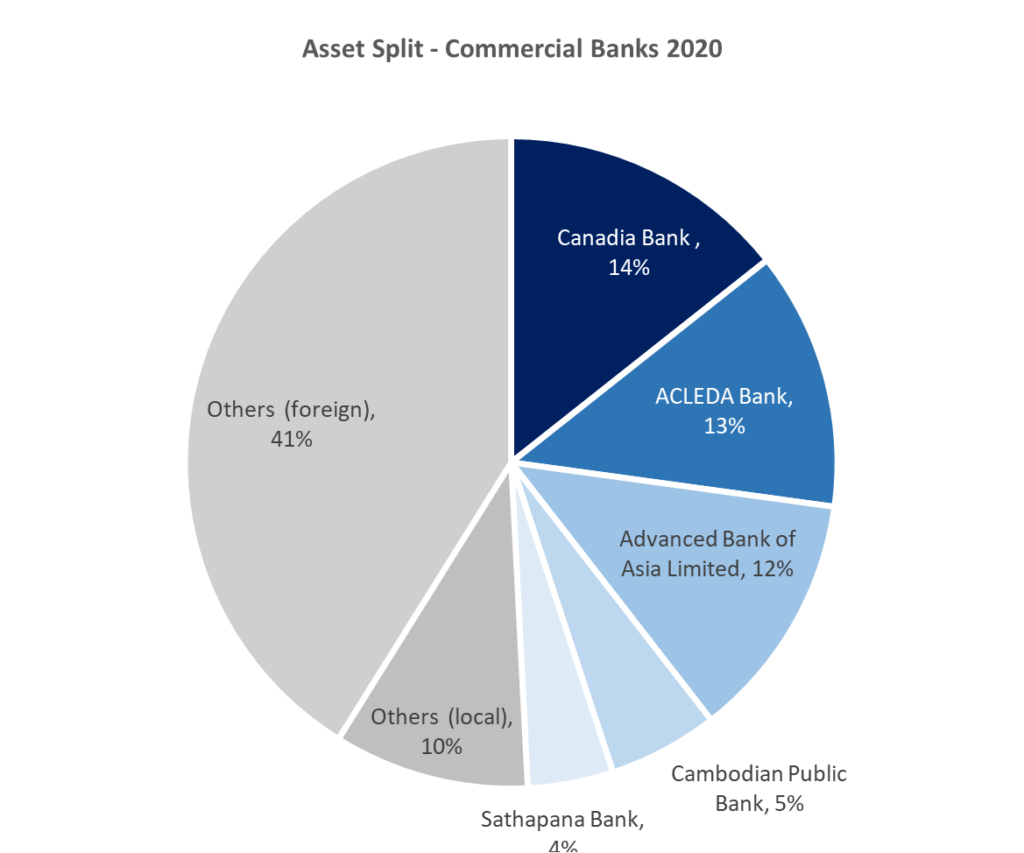

Within the Commercial Banks segment, only 9 players are majority local-owned, representing ~37% of the total asset pool. The top 3 players own ~40% of the total assets.

Diving into trends: Commercial Banks – Heightening liquidity risk, with possible squeeze on ROE in coming years

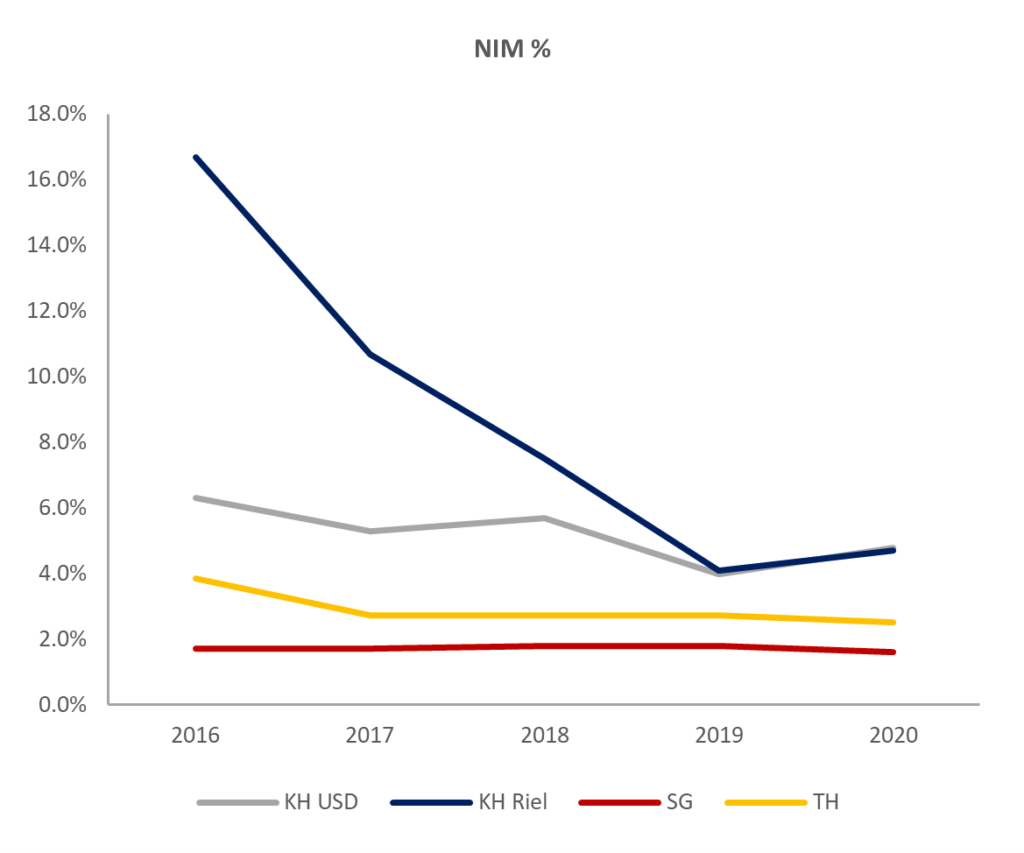

1. Declining Net Income Margin (NIM) and convergence of Riel & USD NIM %

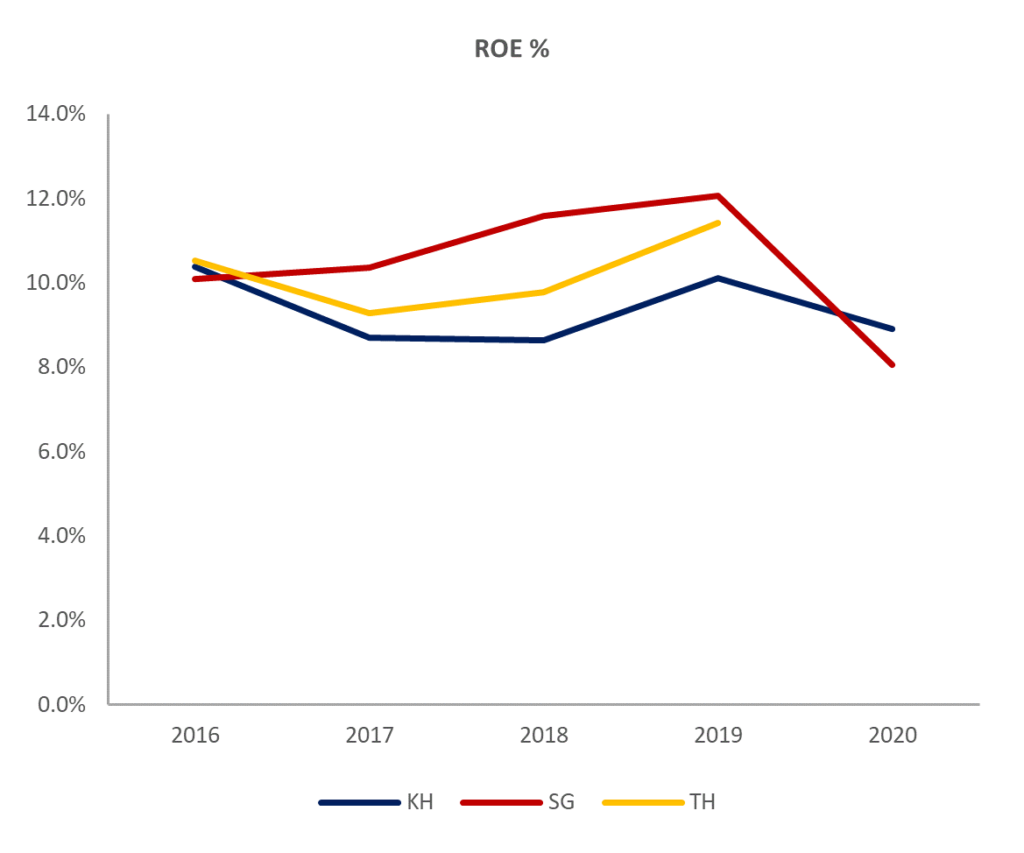

Over the past couple of years, NIM % has been on a steady decline, nonetheless, Cambodia’s NIM is still considerably higher than regional markets. Given that ~80% of commercial banks’ revenue in Cambodia is driven by NIM, that has provided a boost to banks’ profitability and enabled a decent ROE performance in range of 8.5-10.5%. Noticeably, there was an uptick in ROE in 2019, and that may be attributed in part to National Bank of Cambodia (NBC) mandating all financial institutions to hold at least 10% of their loan portfolio in Riel. Traditionally, Riel portfolio has a higher NIM % vs. USD portfolio, although such advantage has thinned out over the years.

2. Heightening liquidity risk with potential rise in NPL % amid an ongoing Covid-19 situation

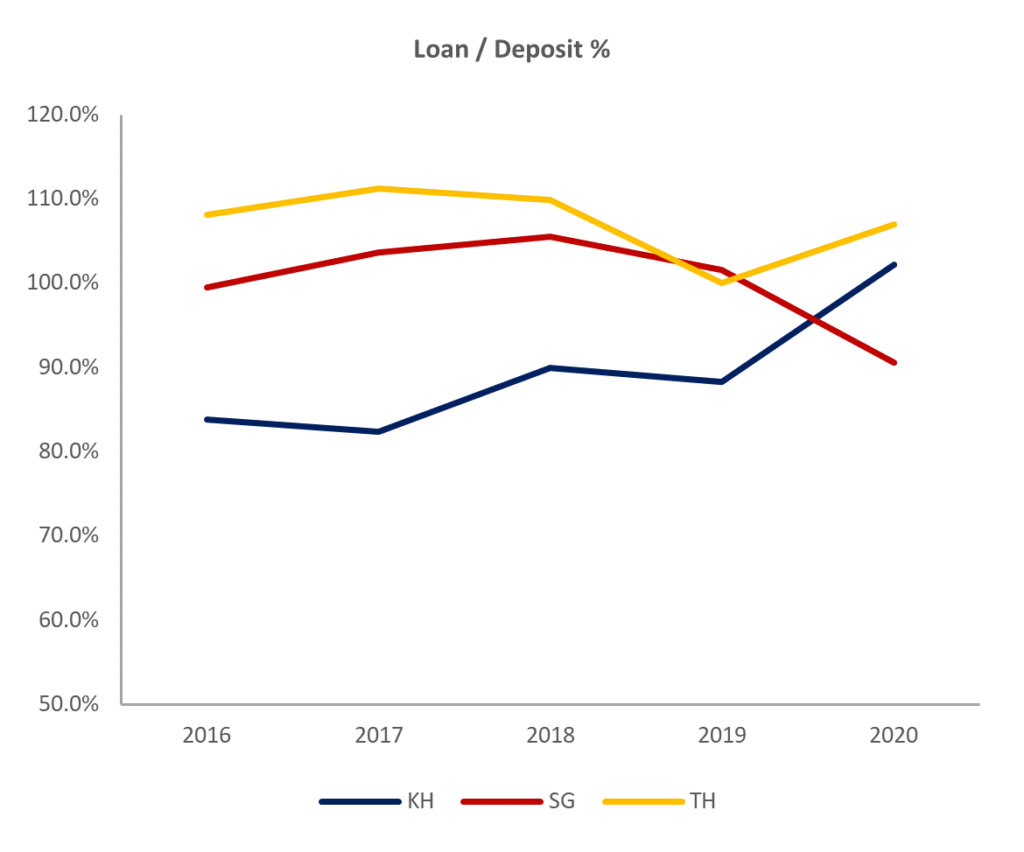

Loan-Deposit Ratio (LDR) for Commercial Banks exceeds 100% in 2020, primarily driven by slowing deposit growth. The last occurrence where LDR > 100% was in 2015. Ideally, a bank’s LDR should be in range of 80-90% to ensure cash on hand for contingencies. An immediate impact of LDR would be a rise in funding cost, which is ideal from a depositor perspective, but less so from a lender perspective. Taking a regional lens, LDR appears to trend on the higher-end, however, banks in Singapore are generally well-funded, with less liquidity concerns. On the other hand, financial systems in Cambodia might be operating on a more fragile fundamental. Another concern is the rising NPL %. Albeit lower in comparison to SG and TH, there are worrying signs for 2021 as Cambodia experiences the full-blown impact of Covid.

3. Persistently high loan growth % vs. GDP growth %

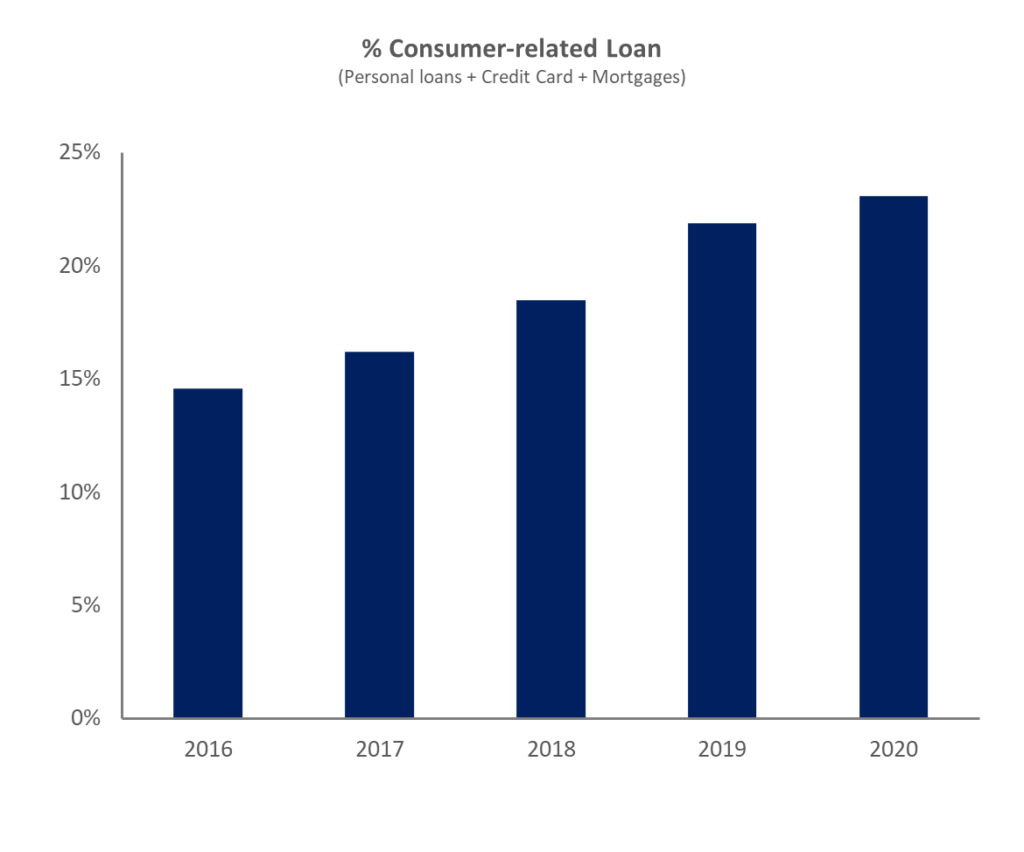

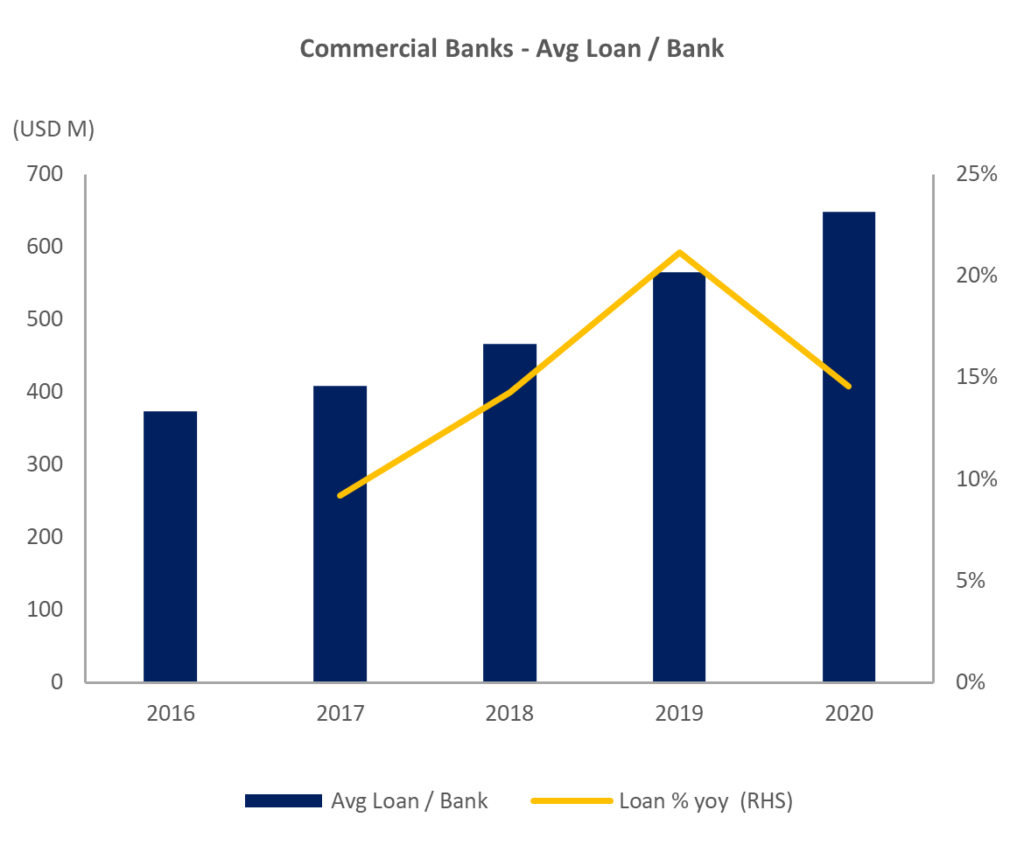

3-year CAGR on commercial banks’ loan growth stands at 24% while similar period CAGR for GDP growth stands at 4%, implying an ~6x multiplier, which looks unsustainable for the overall financial system. Regionally, stable economies’ loan growth vs. GDP growth averages around 1.0-3.0x, highlighting the need for further abating loan growth. Noticeably, it is also worth highlighting consumer-related loans have been the main driver of loan growth in the past couple of years.

Expectations on key themes in Cambodia Commercial Banking Sector

1. Banking consolidation amid increasing pressure on ROE and need for raising minimum capital to ensure soundness of banks

Taking a straight average, loans per commercial bank stands at US$650m. Taking the lowest requirement for CET1 (Common Equity Tier 1 Capital) of 4.5%, the current minimum capital requirement of KHR150,000m (US$37m) can support ~US$820m of risk-weighted asset. Without considering the complications of risk weighting, this implies that players that barely fulfil the minimum cap requirement might soon be approaching their cap on lending. Although current paid-up capital provides room for further loan expansion, the expectation of further squeeze on ROE might imply the industry consolidation looks imminent in the coming years.

2. Digitalisation and integration across the banking, payment, and relevant pillars

Banking in Cambodia can still somehow be termed as “disintegrated” and that presents a barrier to financial inclusion. Transfer of funds across institutions, automated payment system, mobile payment etc. is still in its primitive stage here. Complicating the landscape is the “rat race” among players to independently acquire market with their digital solution roll-out. Nonetheless, the government has recently launched Bakong, a blockchain-enabled solution to gather all participants onto a single platform, where banking and payment can be integrated. The adoption of Distributed Ledger Technology (DLT) shall also offer opportunities to reduce cost of transaction among the participants. Key question now is how long will it takes for Bakong to facilitate financial inclusion in Cambodia, and will it prove to be the right solution? Local success shall also pave the way for cross-border transactions through Bakong.

3. Protection against consumers’ deposits

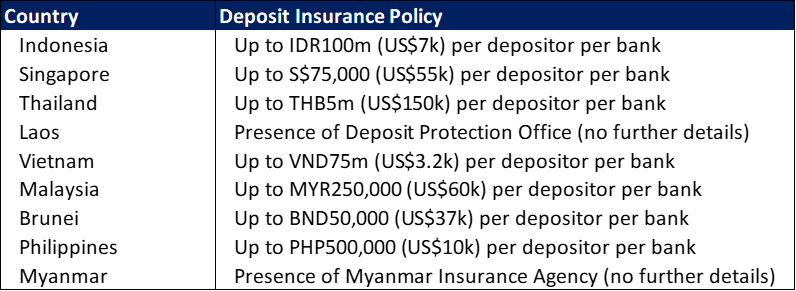

Within ASEAN, Cambodia stands out as the only country that does not have a Deposit Insurance Scheme (DIS). DIS will be an important milestone in providing confidence to the banking and financial system in Cambodia, with depositors assured a minimum deposit recovery in scenario of bank failure. Although there’s cost attached to it, it brings along associated benefits such as: (i) Encourage financial inclusion and retail deposits (ii) Strengthen banks’ financial stability, where cost of insurance can be based upon size of deposits and riskiness of assets (iii) Promote Riel through insuring against Riel deposits.

4. Banking portfolio expansion with increase fee income contribution %

As banking and finance industry matures in Cambodia, commercial banks will see an increasing portion of fee income. In comparison, interest income contributes around 70% of banks’ revenue in Thailand vs. ~80% in Cambodia. There are nonetheless 2 holding back factors (i) Demand (ii) Labour supply. At current stage, given that the financial and securities industry in Cambodia has just starting to take flight, demand for product & services like trade financing, global markets, financial advisory services, brokerage and distribution of insurance products are not well in demand. A second consideration is the lack of talents to fulfil those roles, as such, at initial stage, the country will need to rely upon foreign talents to support the transition.

5. Competition from ASEAN Banking Integration

For long, ASEAN has set its eyes on ASEAN Economic Community (AEC), however, actual implementation is bound to be met with multiple challenges. The ASEAN Banking Integration Framework sets the tone to facilitate the liberalisation of domestic financial markets and harmonisation of regulations across the region. Upon implementation, it is likely to foresee stiffer competition in the banking industry as more established players in SG, MY, TH enter the Cambodian market. However, pressure will tend to be focused upon smaller players.

6. Entrance of digital banks posing threats to traditional banks

Another thought worth considering is when will Cambodia opens up to Digital Banks? Singapore has recently awarded 4 Digital Bank licence and indeed, Fintech is changing the way traditional banking and flow of funds are conducted. Regardless, what it means is the increasing need for commercial banks to embark on digital journey or risk becoming obsolete in the process…

Disclaimer: The information provided on jhterra.com (the “Site”) is for general informational purposes only. All information on the Site is provided in good faith, however we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information on the Site.

References / Data sources:

– National Bank of Cambodia

– Monetary Authority of Singapore

– Bank of Thailand